FINANCE AUTOMATION AGENCY

Accelerate Finance Operations

Transform your financial operations with our automation services, where efficiency meets accuracy, propelling your business towards unprecedented growth and financial clarity.

FINANCE AUTOMATION SERVICES

Improve Financial Operations

The shift towards automation marks a transformative era in finance and accounting, moving from traditional methods to more innovative and efficient practices. This evolution streamlines operations, improves data accuracy, and frees professionals from manual tasks.

As automation increases, finance teams achieve greater operational excellence, gain deeper analytical insights, and can focus on strategic initiatives that drive growth and add value—ultimately redefining financial management in the modern business landscape.

Boosting Efficiency

By automating routine administrative tasks, professionals can now pivot towards the strategic facets of their roles

Minimising Errors

The introduction of automation into financial workflows not only minimises the risk of errors but also streamlines the process of data management

Invoice Management

Automating invoice creation, sending reminders for unpaid invoices, and tracking payments improve cash flow management.

Scalable Growth

Automation equips finance professionals with the capability to manage more clients without a corresponding increase for additional hires.

Competitive Edge

Deliver innovative services, appealing to clients who value modern solutions to their accounting needs.

Work-Life Balance

By significantly curtailing the hours dedicated to manual and repetitive tasks, automation paves the way for a healthier work-life equilibrium.

Reporting

Make more informed decisions faster using automation to make sure all systems are updated in real-time.

Client Communication

Automated yet personalised interactions contribute significantly to improving client satisfaction and bolstering retention rates.

FINANCE TECH STACK

RevOps Consulting across the most popular apps like:

Why Work with Us?

Fast Results

We design a process map of your operations and business apps. This allows us to deliver the quick wins first before looking at longer term strategy.

Pay as You Go

We can work with you over a long period, delivering value to your organisation.

Financial Savvy

Many years of experience with accounting and ERP applications, along with the most popular source and destination apps, aid our integration efforts

Hourly Rate @£90

We provide a variety of services at a rate of £90 per hour plus VAT, without requiring long-term contracts.

A few "examples" of our Finance Automation Services

ACCOUNTING APPS

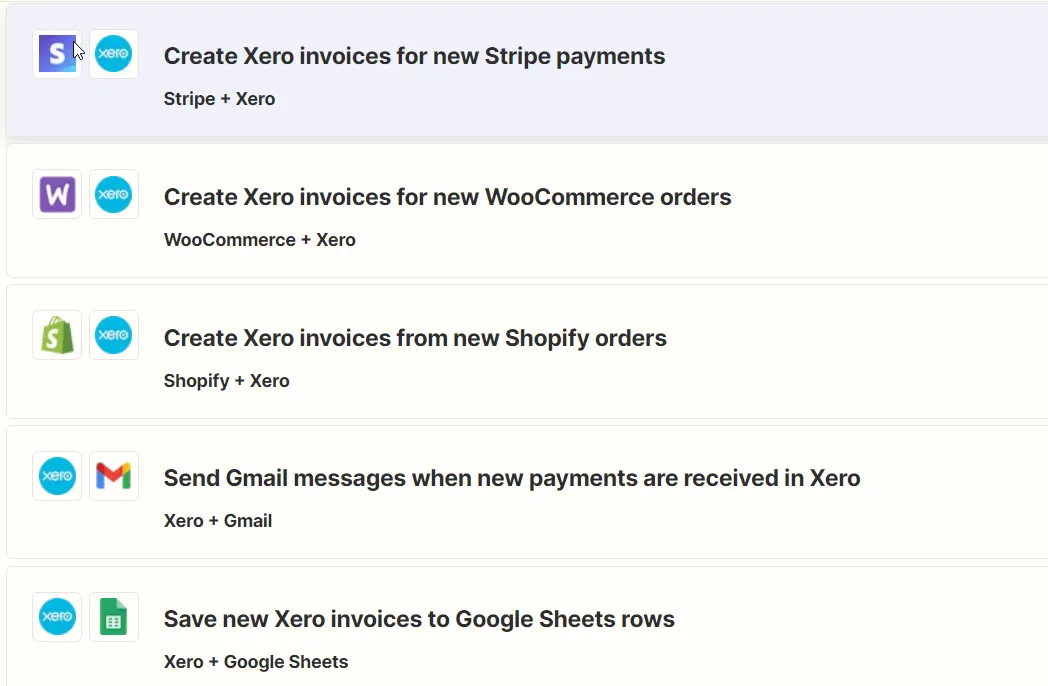

Xero Automation

Xero with automation streamlines numerous accounting and business processes to connect with hundreds of other apps. A few example automations include:

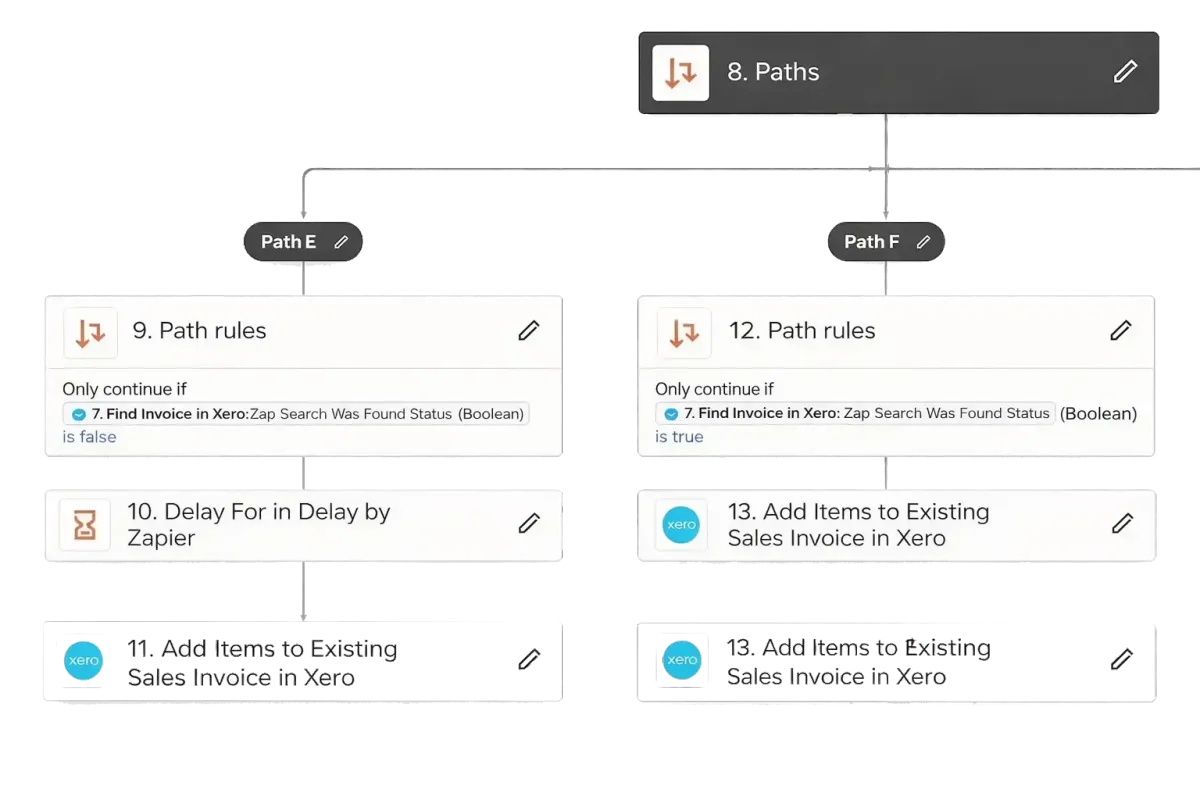

Invoice Automation: Automatically create invoices in Xero when sales are made in other platforms such as e-commerce sites (Shopify, WooCommerce) or when a deal is closed in a CRM (Salesforce, HubSpot).

Expense Management: Set up workflows to create expense claims in Xero whenever expenses are submitted through apps like Expensify or Google Sheets.

Payment Updates: Automatically update or notify your team in Slack, or update your CRM when payments are received in Xero to keep everyone in sync.

Financial Reporting: Generate and send custom reports when new financial data is entered or updated in Xero to apps like Google Sheets. Google Looker Studio Cloud or via email.

ACCOUNTING APPS

Sage Automation

We can automate actions based on triggers in Sage or update Sage based on activities in other apps. Examples include:

Automatically Create Invoices: You can set up a workflow that automatically creates invoices in Sage whenever a new sale is recorded in your CRM or e-commerce platform..

Expense Management: Automatically create entries in Sage when expenses are recorded in apps like Expensify or Receipt Bank

Improve Data Accuracy: Eliminates manual data entry and reduces inconsistencies by keeping records automatically aligned across systems.

Payment Updates: Automatically update your CRM or send notifications when payments are recorded in Sage.

CONNECT YOUR ORGANISATION

Enhancing Payroll Management

Simplify payroll operations by connecting time tracking, payroll, and accounting systems into a single automated workflow. Reduce manual processing, improve accuracy, and maintain compliance as your organisation scales. Our approach:

Streamlined Payroll Processing: Integrate payroll software (e.g., Gusto, Paychex) with time tracking apps and accounting systems via automation for efficient payroll management.

Automated Updates & Distribution: Automate payroll expenditure updates in accounting software and distribute pay stubs, enhancing procedure reliability.

Accurate Hour Calculation: Ensure precise calculation of worked hours and overtime for accurate, timely payroll processing, reducing manual errors.

Labour Law Compliance: Ease administrative burdens and ensure adherence to labour laws, safeguarding against potential legal issues.

INCREASE EFFICIENCY

Enhancing Cash Flow Management

Improve financial stability by automating billing, receivables, and cash flow monitoring. Automation ensures faster payments, improved visibility, and proactive financial control. Our approach:

Streamlined Invoicing & Receivables: Automate invoicing and accounts receivable processes with automation to ensure timely dispatch and follow-up on overdue payments.

Accelerated Payment Receipts: Speed up client payment receipts to improve company cash flow.

Proactive Financial Management: Automated alerts for key financial indicators enable proactive management of finances.

Improved Payment Cycles: Enhance payment cycles for timely billing and diligent payment follow-ups, supporting business growth.

BETTER UNDERSTANDING

Real-time Unified Reporting

Gain clear, real-time visibility into your financial performance without relying on manual reporting. Automated reporting ensures stakeholders always have access to accurate, up-to-date insights. Our approach:

Streamlined Reporting Process: By automating report creation and sharing, close the gap between data gathering and actionable insights, enhancing strategic decision-making.

Real-Time Financial Insights: Automate the creation of financial reports for instant access to crucial financial data, ensuring stakeholders are always informed without the delay of manual report generation.

Seamless Data Integration: Automatically pull data from accounting software to reporting tools or dashboards, offering an up-to-date view of financial standings.

Quick Issue Identification: Automated financial reporting highlights potential financial issues or opportunities faster than traditional methods, aiding in timely intervention and strategic planning.

Critical Alerts Setup: Establish alerts for important financial thresholds, enabling proactive measures and swift response to financial changes.

STREAMLINE PROCESSES

Client Communication and Updates

Enhance client understanding and satisfaction by automating financial communications and service updates. Reduce manual follow-ups while ensuring consistent, timely communication. Our approach:

Automated Client Communications: Sync your email platform with CRM and accounting software to send automatic payment reminders and tax notices, ensuring consistent updates to clients.

Focus on Strategic Tasks: Minimise time on administrative duties, allowing more focus on strategic planning and enhancing client services, thereby improving operational efficiency and client satisfaction.

Personalised Client Interactions: Set up automated, personalised interactions to boost client satisfaction and retention.

Streamlined Service Delivery: Automated workflows keep clients and team members well-informed with timely alerts and reports, reducing miscommunication.

REDUCE OPERATIONAL COSTS

FREE CONSULTATION

Feel that your accounting operations can be improved? They can – and we're here to make it happen. Take the opportunity now for a complimentary, no-obligation consultation.

Financial Optimisation

Work with a dedicated partner that offers a personalised service that aligns with your company's short and long-term goals.

We can help you:

Identify friction within current accounting processes.

Map out improvements to streamline, automate and improve overall efficiency

Reduce costs by doing more work for less internal costs

Scale operations without sacrificing the quality of work

Connect your financial department internally, and externally with other departments

Newquay Orchard

Trevenson Road

United Kingdom

TR7 3BW

© 2026 OpScaling. All Rights Reserved . Privacy Policy